1. Chapter Introduction

2. Capital & Revenue Expenditure

3. Deferred Revenue Expenditure

4. Capital & Revenue Receipts

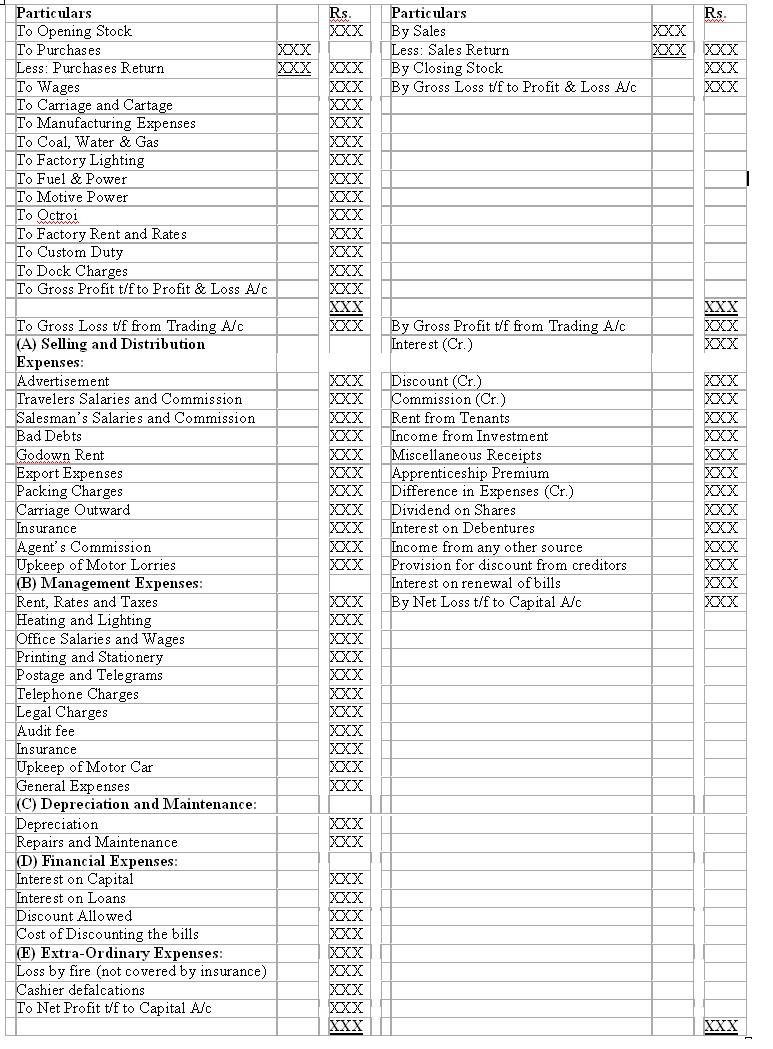

5. Trading Account

6. Trading Account: Items

7. Profit & Loss Account

8. Depreciation

9. Inventory Valuation

10. Profit

1.Chapter Introduction

In the previous chapter, you have studied about the balance sheet. It is intended for reporting the value of assets, liabilities and owners' equity at a particular point in time. It does not disclose any thing about the details of the business. So another statement is required to summarize revenues and expenses of the particular period. This statement is referred to as profit & Loss Account, Income statement or Income summary.

The Profit & Loss account summarizes all the revenues or incomes and all the expenses for earning that revenue showing the net difference, that is profit or loss for the period.

2.Capital & Revenue Expenditure

In fact every expense is expenditure, but each expenditure is not necessarily an expense. They are definitely not synonyms. Those business expenses, which affect directly the profits for the accounting period, are called Revenue Expenditure. Those which do not directly affect the profit, but the benefits of which result over longer periods of life of the business (say five to ten years) are called Capital Expenditure. The revenue expenditure or expense is shown in P & L A/c while the capital expenditure is shown in Balance Sheet.

Capital Expenditure

All expenditure incurred in acquiring fixed assets, or improving the existing ones by increasing its efficiency (e.g. by providing substitution, alteration or renovation), or effecting economy in operation of existing assets (e.g. by attaching power motor to hand driven machine) are called capital expenditure. These expenditures are intended to be permanently used in business and they increase the earning capacity of the enterprise. They mayor may not reduce the existing expenses. The following types of expenditures fall under this category:

- Expenditure incurred on any tangible or intangible asset, which can be sold or converted into Cash in future.

- Expenditure incurred on improving an existing asset so as to increase its earning capacity.

- Expenditure incurred on a new asset to bring it to workable condition.

- Expenditure for acquiring a capital asset.

- Payment for Goodwill.

- Cost of freehold Land & Building.

- Cost of Leasehold Land.

- Payment for acquiring Trademark, Patents, Copyright, Pattern & Design etc.

- Plant and Machinery and Furniture purchased for the use in business.

- Motor Car, Truck, etc. for the use in business.

- Installation expenses of Plant & Machinery.

- Expenses of Electric Fittings.

- Addition to the value of present assets.

- Expenditure on extension of mines and gardens.

- Acquiring an asset and spending on its erection, etc.

Revenue Expenditure

They are all such expenses, which are incurred on the organisation and for running the business. The benefits of such expenses are limited to the accounting period only. They are incurred to maintain the earning capacity of the business, whereas capital expenditure are incurred to improving the earning capacity of the business. The following types of expenditures are usually called revenue expenditure.

- Expenditure incurred on acquiring raw material and business goods.

- Such expenditure whose advantage does not last for more than a year.

- Expenditure incurred for the maintenance of an asset.

- Expenses to run the business efficiently e.g. office expenses. Financial expenses, selling expenses, distribution expenses etc.

- Cost of Raw material.

- Goods purchased for re-sale.

- Wages paid.

- Administrative Expenses wages, salaries, insurance, rent and advertisement etc.

- Repairs and upkeep of fixed assets.

- Annual rent of Leasehold Land.

- Loss due to fire

- Distribution expenses.

- Selling expenses.

- Interest on Loans.

- Depreciation, etc.

Exceptions to the General Rules

- Raw Materials: When raw material is used for the manufacture, of an asset it is treated as Capital expenditure.

- Wages and Salaries: This is revenue expenditure. But when wages and salaries are spent for the construction of a building or for installation of a machine then it is treated as Capital expenditure.

- Carriage and Freight: These are also revenue expenditures but Carriage and Freight paid for bringing the machine to the godown, then it is treated as Capital expenditure.

- Repairs and Renewals: These are revenue expenditures but when an old machine is purchased and some amount is spent to bring it to a workable condition then it is called Capital expenditure.

Difference between Capital & Revenue Expenditure:

- Capital expenditure is the capital outlay on acquiring new assets, improving the existing ones, not with the intention of reselling them. Revenue expenditure is the routine types of recurring expenses, which are incurred for running the business. Besides, they include expenses for maintaining the upkeep of the existing assets.

- Capital expenditure increases the earning capacity of the business, whereas, Revenue expenses do not.

- The benefits of the capital expenditure are always spread over several years, whereas the revenue expenditure provides benefit only for the accounting period. That is the reason why only a part of the capital expenditure is accounted for in the accounting period and the balance is shown as an asset in the balance sheet. On the other hand, the entire amount of the revenue expenditure is accounted for in the accounting period. The nature of the two kinds can be better understood by the following example:

3.Deferred Revenue Expenditure

Sometimes some expenditure is incurred which by nature is revenue expenditure, but its benefits are likely to be derived over a number of years. If revenue expenditure is incurred during the current year but paid as advance for the coming year(s), such expenditure is called 'Deferred Revenue Expenditure'. For example a firm may undertake a special advertising campaign for a new product and say spends rupees one lakh over it. The benefit of this advertisement may continue for say ten years. As such only one-tenth of this expenditure should be considered as revenue expense for the year and taken to P & L A/c and the rest as Deferred Revenue Expenditure and taken to balance sheet as asset. Such expenses are also sometimes called Capitalized Expenditure. Usually the deferred revenue expenditure are of the following types:

- Partly paid in advance. These are expenses, the benefits of which accrue to the current year as also to the future years. The utilized portion is accounted for the current year and the unused portion is shown as asset in the balance sheet.

- Wholly paid in advance. These are expenses, the benefit of which does not accrue to the current year, but the amount is paid during this period. As such the total amount is shown as asset in the current balance sheet.

- Unusual and abnormal losses. The business may get a shocking setback if the total abnormal losses are accounted for in one year. Loss by theft or fire may have to be spread over a few years. Some portion of it is accounted for in the current year and the unwritten portion is shown as an asset in the current balance sheet. Of course, this will be a worthless and fictitious asset.

- Expenditure for development, improvement and alterations are revenue expenditure but treated as capital expenditure.

- These expenditures are not immediately written off in the year of actual expenditure but split over a period of certain years as per the decisions and policies of the management.

- These expenditures are treated as assets and shown at the assets side of the Balance Sheet.

4.Capital & Revenue Receipts

Revenue receipts, like revenue expenditures affect the P & L A/c and are shown on its credit side. Capital receipts, like capital expenditures do not affect profit, and are either shown as a liability or more often as a reduction from the assets. Any excess realisation over the book value of an asset may, however, be treated as a revenue receipt and accounted for as such. It is, therefore, essential to know the distinction.

Examples of Capital Receipts:

- Capital invested by the owners of the business.

- Amount received from sales of fixed assets or investments.

- Conversion into Cash of any Asset except stock.

- Loans received.

- Amount from sale of goods.

- Amount received from rendering services to other parties or interest received or commission received.

Capital Loss and Revenue Loss. Capital loss is that loss which occurs due to sale of some fixed asset. For examples, loss due to issue of shares or debentures at a discount, loss due to misappropriation of Cash from the office or forfeiture of security deposited for getting an agency. Revenue losses are those losses, which occur due to sale and purchase of goods. For example, Bad Debts, loss due to fall in the price of goods, etc.

Whereas revenue loss is usually accounted for in the current year's P & L A/c, capital loss is usually spread over a few years.

5.Trading Account

"The Trading Account shows the results of buying and selling of goods. In preparing this account, the general establishment charges are ignored and only the transactions in goods are included." -J.R. Satliboi

The income statement is split into two parts. The first is called the Trading Account and the second the Profit and Loss Account. The trading account is designed to show the gross profit on sale of goods. This is achieved by setting against the net proceeds of sale, the cost of goods sold. The Trading Account contains, in a summarized form, the transaction of the trader relating to the commodities in which he deals, throughout the accounting period. All expenses, which relate to either purchase of raw material or production or manufacturing, are charged to the Trading A/c. It is prepared to find out Gross Profit or Gross Loss. If the sales are more than purchases and expenses the result is Gross Profit and vice versa.

In the beginning of the year the businessman has stock left from the last year. It is called Opening Stock. The goods remaining unsold this year is called Closing Stock. While preparing Trading A/c, Opening Stock is added to the Purchases and Closing Stock is added to the Sales. Trading A/c shows the Gross Profit or Gross Loss. The businessman can, with the help of Trading A/c compares the Purchases, Sales and Closing Stock of the current year with those of the last years. He can easily find out the ratio of Gross profit to the Sales and thus control his business expenses.

For a small businessman, Trading Account serves the purpose of Manufacturing Account as well. But a big businessman usually has to prepare a separate manufacturing account. The description of this account will be given at the appropriate place on pages to follow.

Importance of Preparing Trading Account

Preparation of Trading account serves the following objectives and provides data for comparison analysis and planning for future growth. The purposes are:

- It provides information about gross profit. The current figure can be compared with earlier ones and reasons found for variations. Accordingly plan can be launched for future growth of the firm.

- Ratio of gross profit to sales can help the trader to improve his business administration.

- Ratio of direct expenses to sales will help the trader to control and rationalize the expenses.

- Comparison of 'stock in hand' of the current year with those of the previous years. Reasons for variation can be found out and steps can be taken to adjust things more profitably.

- Ratio of cost of goods sold to total sale proceeds can help the trader in fixing the prices of his products.

- Precautionary measures can be taken to avoid possible losses by analyzing the items of direct expenses.

Gross Profit disclosed by the Trading Account tells us the upper limit within which one should keep the operating expenses of the business besides saving something for himself. In case of new products, the businessman can easily fix up the selling price of the products by adding the cost of purchases, the percentage gross profit that he would like to maintain.

6.Trading Account: Items

Stock - The goods remaining unsold is called stock. It is of two types:

- Opening Stock: In the beginning of the year the businessman has some unsold goods of the last year. It is called opening stock. It is shown on the debit side of Trading A/c.

- Closing Stock: The goods remaining unsold at the end of the year is called Closing Stock. It i_ shown on the credit side of the Trading A/c. Opening Stock is given in the Trial Balance and Closing Stock is given below the Trial Balance because closing stock is valued after the accounts have been closed.

Valuation of Closing Stock

Closing Stock is valued at cost price or market price whichever is less. For example, the businessman purchased goods for Rs. 2,000 but at present its market value is Rs. 2,500. It will be valued at Rs. 2,000 and not at Rs. 2,500. Another goods costs Rs. 3,600 but now its present value are Rs. 2,600. It will be valued at Rs. 2,600. This decision is followed on the principle that a gain cannot be treated a gain unless it is actually received but a loss is treated as loss when it is clearly visible. Thus we can say expected gain is no gain but expected loss is a loss.

Closing Stock should be valued very carefully and correctly. A list of the unsold stock should be carefully prepared and its price written against every item. This work should be done by capable and experienced person and checked by some reliable officer. It should be kept in mind that if the Closing Stock were valued at a higher price the Gross Profit of the business would be wrong and misleading.

Goods to be included in Closing Stock

- Goods remaining unsold at the end of the year are called Closing Stock.

- If there are other branches of the business the closing stock of all the branches should be included.

- If goods have been sent on Consignment the stock remaining unsold with the consignee should also be included.

- If the businessman has not taken into consideration some purchases or sales returns these should also be included in the Closing Stock.

Component of Closing Stock

- Stock of Raw Materials. If the businessman is a manufacturer and he will be having some stock of raw material at the end of year it should be included in the Closing Stock.

- Stock of Finished Goods. The part of the finished goods unsold should also be included in the Closing Stock.

- Stock of Work- in-progress. The goods which is not ready but is expected to be ready shortly is called Work-in-progress and should also be included in the Closing Stock.

- Stores. The goods required for converting the raw material into finished goods should also be included in the Closing Stock. e.g., machine oil, chemicals, coal, gas, etc.

Purchases and Purchases Returns

Purchases Account tells the quantity of total goods purchased and the Purchases Returns A/c shows the goods returned out of purchases. It is shown on the Trading A/c in the following manner:

To Purchases

Less Purchases Returns

Direct Expenses

These are those expenses that are included in the manufacture of goods or expenses incurred in importing goods and carrying them to the godown. In other words we can say those expenses that are incurred in bringing the goods to saleable condition are called direct expenses. Direct expenses include the following:

- Wages: It is shown on the debit side of the Trading A/c and shows the wages paid in the production of goods.

Note 1. If wages are paid for bringing a new machine or for its installation, it is treated as part of the cost of the machine and is shown in the Assets.

Note 2. If the expense is recorded as 'Wages and Salaries' it would go to Trading A/c. If it is 'Salaries and Wages' it would go to P & L A/c.

- Carriage Inward: Carriage paid will be shown on the debit side of the Trading A/c. Carriage outward is shown on the debit side of Profit and Loss A/c.

- Manufacturing Expenses: All those expenses, which incurred in manufacture of goods, are shown on the debit side of the Trading A/c. e.g., factory fuel and oil, factory lighting, coal and gas, etc. If lighting of the factory and office are given together then they are apportioned.

- Carriage and Freight: Carriage and freight paid for bringing the goods purchased is a direct expense and debited to Trading A/c.

- Sales and Sales Returns: Sales are shown on the credit side of the Trading Ale but to arrive at Net Sales the Sales returns should be deducted.

7.Profit & Loss Account

According to Prof. Carter, "A Profit and Loss account is an account into which all gains and losses are collected in order to ascertain the excess of gains over the losses or vice versa".

It must be remembered that expenses relating to the owner or partners are not to be accounted for in the Profit and Loss A/c of the firm. They are personal expenses and hence are transferred to the Drawings A/c of the owner or partners. These expenses are usually (i) Life insurance premium, (ii) Income tax, and (iii) Household or personal expenses.

The objectives of preparing P & L A/c can be briefly summed up as under:

- Provides information about Net Profit;

- Comparison of current year's income with that of the previous year's can be made;

- Concrete steps may be taken to increase the net profit in future through analysis of expenses.

- Proper allocation of net profit can be made among partners and provision for various types of Reserves as also for Research and Development programs can be made.

Importance of Profit and Loss Account

The purpose and importance of preparing Profit and Loss Account is as under:

- The purpose of preparing profit and loss account is to ascertain the amount of net profit or net loss. This is the actual profit available to the proprietor and credited to his capital account. In case of net loss his capital account will be debited. The net profit is calculated after charging all indirect expenses.

- It is an index of the profitability or otherwise of the business. The profit figure disclosed by the profit and loss account for a particular period can be compared with that of the other period. Thus, it helps in ascertaining whether the business is being run efficiently or not.

- An analysis of various expenses included in the profit and loss account and their comparison with the expenses of the previous periods helps in taking steps for effective control of the various expenses.

- The net profit is matched with the net sales to calculate net profit ratio'. This ratio is compared with the desired ratio and if there is any short-.coming, that will be removed. Similarly expenses ratio to sales is calculated. It will always be in the interest of the firm that the expense ratio should be the minimum.

- Allocation of profit among the different periods or setting aside a part of the profit for future contingencies can be done. The amount of provisions, reserves and funds to be maintained depends upon net profit earned by the firm.

- We can adopt effective future line of action on the basis of information available from profit and loss account regarding net profit and other expenses.

Trading and Profit & Loss Account

for the year ended ---

- Materiality: It means the relative importance of an item or amount in a given situation. Thus all significant points, which are likely to influence the investment, decisions or otherwise of various users of this statement must be disclosed. For example, if large quantities of raw materials are sold resulting in the considerable profit or loss, such a sale should not be included in the Sales Account. Instead, profit or loss on this item must be shown separately. What is material or not will depend on individual case.

- Prior-period items: They may be defined as material charges or credits which arise in the current accounting period as a result of errors and omissions in the preparation of financial statements of one or more prior periods. As a rule the profit and loss account should disclose the working of the company during a particular year. It is therefore imperative that items of income and expenditure must pertain to that year only. When the provision for expenses made during the previous year is less than the actual expenditure during the year, the excess of expenditure over the provision made during the previous year, should be disclosed in the profit and loss account separately, if it is material in natures. For example salaries of the University employees have been revised with effect from January 1996 but the decision was taken only in March 1998. The increased salaries for 1997-98 can certainly be absorbed in the 1997-98 salaries but the increased salaries for three months of 1996-97 will also have to be accounted for and instead of clubbing them with the salaries of the current year, they should be shown separately. ICAI opines that prior period items should be stated in the profit and loss appropriation' section when profit and loss account is prepared in a horizontal (account) form. In the case 6f profit and loss account prepared in the vertical form, the same purpose can be achieved by arriving at current year's result and thereafter adding or deducting therefrom, as the case may be the prior year items. [Compendium of Opinions 2nd Ed. p. 29]

- Extra-ordinary items: AS-5 defines such items as gains or losses which arise from events or transactions that are distinct from the ordinary activities of the business and which are both material and expected not to recur frequently or regularly. For example, profit or loss from the sale of fixed assets or speculation gains or losses are unusual items not connected with the ordinary activities of the business. Though such items should be shown in the profit and loss account as a part of net income but the nature and amount of each such item should be disclosed separately in a manner that their relative significance and effect on the current operating results can be easily seen.

- Change in accounting policies: A change in accounting policy such as method of inventory valuation or change in rate or method of depreciation should be disclosed with its effect on profit or loss resulting from such a change. AS-5 recommends that a change in accounting policy should be made if the adoption of a different accounting policy is required by the statute or for compliance with an accounting standard or if it is considered that the change would result in a more appropriate preparation or presentation of the financial statements of an enterprise.

- Accrual basis of accounting: Section 209 (3) requires every company to keep its books of account on accrual basis and follow the double entry system of accounting popularly known as mercantile system of accounting which alone discloses a true and fair view of the state of affairs of a company. The accrual basis of accounting records the financial effects of the transactions, events and circumstances of an enterprise in the period in which they occur rather than recording them in the periods in which cash is received or Raid by the enterprise. The main objective of the accrual basis of accounting is to relate the accomplishments (measured in the form of revenues) and the efforts (measured in terms of cost) so that the reported net income reflects the performance of the enterprise during a period rather than being a mere listing of its cash receipts and payments [ICAI: Guidance Note' on Accrual Basis of Accounting]

Major items as per part II of Schedule VI

The main contents of profit and loss account are outlined below:

- Turnover or Sales: The aggregate amount for which sales are affected by' the company and connected items with the turnover such as commission paid to sole-selling agents [Section 294];- and other selling agents and brokerage and discounts on sales other than usual trade discount.

- Cost of sales, stocks and work-in-progress: The details in respect of these items are to be given as : (a) the purchase of raw materials and the opening and closing stock of the goods produced for a manufacturing concern;(b) in the case of trading concerns, 'the purchases made and the opening and closing stocks. The term raw materials would include materials, which physically enter into the composition of the finished goods. Monetary and quantitative information regarding opening and closing stocks have to be given in respect of each class of goods. In addition, the opening and closing balances of work-in-progress are also to be given.

- Stores, power, rent, repairs, salaries etc.: These are to be stated separately as the consumption of stores; power and fuel, rent, repairs to building, machinery; salaries, wages and bonus; contribution to provident fund and other funds-staff and workmen welfare-rates and taxes etc.

- Depreciation: The amount provided for depreciation, renewals, diminution in the value of fixed assets and the method adopted for such a provision, where no such provision is made and the details regarding arrears of depreciation as per Section 205(2) shall be disclosed by way of foot note.

- Interest on loans and debentures: Interest on different types of loans and company's debentures has to be stated separately. It will include the amount of interest paid as well as payable.

- Miscellaneous expenses: This head includes items such as rent, rates and taxes, insurance premium etc., which must be stated separately. It is provided that in case an item exceeds one per cent of total revenue of the company or Rs. 5,000, whichever is higher, such an item should be shown as a separate and distinct item in the profit and loss account.

- Managerial remuneration: The payments made to directors or managers of the company have to be stated in the profit and loss account in the form of managerial remuneration, other allowances and commission, directors' fees, pension, gratuities, etc.

- Payments to auditors: The payments made to auditors as auditors and in any other capacity must be stated separately. This will include audit fees, consultancy fees for taxation matters, company law matters, and management services and in any other matter etc.

- Payment of-interim relief: Interim relief is normally given to employees till the final settlement of wages. At the time of final settlement, the amount of interim relief is absorbed or merged with the final regular wages. Thus the interim relief granted to the employees is normally not in the nature of an advance, as the said amount is not deducted from the wages of the employees after final settlement. Accordingly the amount in respect of interim relief should be treated as an expense in the year in which it is paid under the appropriate head and is not to be treated as an advance.

- Premium paid on insurance covering gratuity liability: The premium of LIC policy taken for covering the gratuity liability is worked out by the actuarial valuation of increase in gratuity liability during the year; it is not based on time factor. As the premium is not based on time factor, the premium paid may be debited to the profit and loss account for the year. There IS no question of prepaid premium.

8.Depreciation

Q. Distinguish between Straight Line and Written Down Method of providing depreciation. (Dec. 01)

Straight Line Method/Original Cost Method/Fixed Instalment Method: Under this method, the amount of depreciation is uniform from year to year. This fixed amount of depreciation is charged to Profit and Loss A/c every year. The annual amount of depreciation can be easily calculated. Out of the cost of the asset its scrap value id deducted and it is divided by the number of years of its estimated life.

|

Depreciation |

|

Original Cost – Scrap Value |

|

= |

|

|

|

|

Estimated life of Asset |

Difference between Straight Line Method and Written Down Value Method

- Amount of Depreciation: The amount of depreciation remains the same all the years under straight-line method, while it goes on decreasing every year under the written down value method.

- Computation of Depreciation: Under straight line method of depreciation, depreciation is charged on the original cost of the asset, while it is charged on the reducing balance every year under written down value method.

- Value of Asset: Under the straight line method the value of the asset become nil at the end of its working life but it never becomes nil under the written down value method.

- Rate of Depreciation: Normally, the rate of depreciation is lower under straight-line method whereas it is higher under the diminishing balance method.

- Recognition: The straight line method of depreciation is not recognized by the income tax authorities while the later method is well recognized by them.

9.Inventory Valuation

Q. Distinguish between the FIFO and LIFO methods of inventory valuation. (Dec. 01)

|

Basic of Distinction |

FIFO |

LIFO |

|

1. Basic Assumption |

Goods received first are issued first. |

Goods received last are issued first. |

|

2. Cost of goods sold |

Cost of goods sold represents cost of earlier purchases. |

Cost of goods sold represents cost of recent purchases. |

|

3. Ending Inventory |

Ending inventory represents cost of recent purchases |

Ending inventory represents cost of earlier purchases. |

|

4. In case of rising prices |

Higher income is reported since old costs (which are lower that current costs) are matched with current revenue. As a result, income tax liability is increased. |

Lower income is reported since current costs (which are higher that the old costs) are matched with current revenue. As a result, income tax liability is reduced. |

|

5. Distortion in Balance Sheet |

Balance Sheet shows the ending inventory at a value neared the current market price. |

Balance Sheet is distorted because ending inventory is understated at old costs. |

10.Profit

Q. Explain the following:

- Gross Profit

- Operating Profit (June 01)

- Net Profit (June 02)

Gross Profit: Gross Profit is obtained by subtracting the cost of goods sold from Net sales.

Mathematically

Gross Profit = Net Sales – Cost of Goods Sold

Cost of Goods Sold = Opening Stock + Net Purchases + Direct Expenses – Closing Stock

And Net Sales = Total Sales – Sales Return

Operating Profit (June 01): Operating Profit means profit earned by the concern from its business operation and not from the other sources. While calculating the net profit of the concern all incomes either they are not part of the business operation like Rent from tenants, Interest on Investment etc. are added and all non-operating expenses are deducted. So, while calculating operating profit these all are ignored and the concern comes to know about its business income from its business operations.

Mathematically

Operating Profit = Gross Profit – Operating Expenses

Or Operating Profit = Net Profit + Non Operating Expenses – Non Operating Incomes

And Net Sales = Total Sales – Sales Return

Net Profit (June 02): This is the amount ultimately available to the company for appropriation. This amount could be either distributed as dividends to shareholders or retained in the business as retained earnings. This is variously referred to as PAT (Profit after tax) or EAT (Earnings after tax). After subtracting dividends declared, and surplus remaining is added to retained earnings, that is, reserves & surplus.

Mathematically

Net Profit = Gross Profit – Selling and Distribution Expenses – Office and Administration Expenses – Financial Expenses – Non Operating Expenses + Non Operating Incomes.

And Net Sales = Total Sales – Sales Return

Q. Distinguish between gross profit, operating profit, & net profit. (June 99, June 98)

Please refer to the previous question for details.